This is where a DCA strategy can help investors avoid missing out on investing in an asset which has high short-term price volatility but great long-term value-appreciation potential. In financial trading, a drawdown refers to how much an account has fallen from its peak to its trough in terms of the capital or investment amount.

Timing the market is a difficult, if not impossible, task and it’s too time-consuming to study the short-term market movements for most investors. It is usually quoted as a percentage of the peak value.

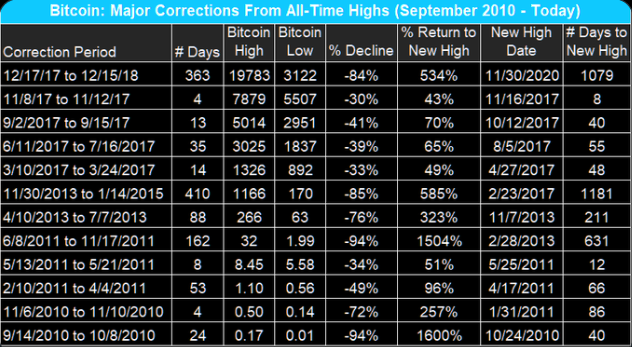

#Bitcoin maximum drawdown series

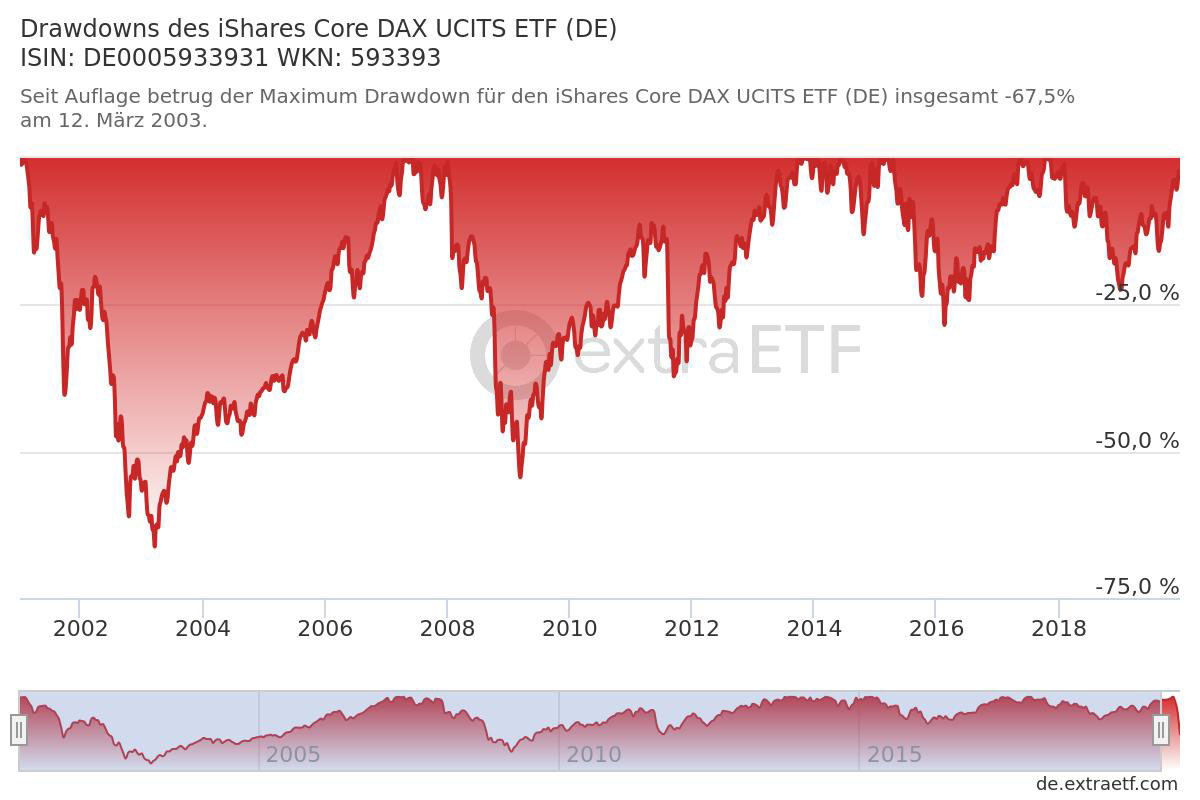

It is the reduction in asset value after a series of losing trades. We men- tioned the 83 drawdown in bitcoin in 2018. Maximum drawdown is defined as the peak-to-trough decline of an investment during a specific period. Smart Bitcoin Maximum DrawdownMaximum Drawdown (or MDD) is another indicator of risk. These stats serve as a timely reminder as Bitcoin momentum has waned in recent weeks. It reduces the exposure of short-term price risk of entering at the “wrong time” for an asset that has long-term appreciation potential. In Panel B, we show maximum year-on-year drawdowns over trailing 12-month periods. As we can see, the price of Bitcoin has entered nearly 20 distinct bear markets over the past ten years, and has been in a drawdown greater than twenty-percent for nearly 80 of its history. This strategy has long been advocated by investing legend Warren Buffett for navigating volatile markets. The key to this strategy is committing to purchasing a fixed dollar sum at a fixed interval, regardless of price! Specifically, the monthly volatility is cut by nearly 75 compared to the portfolio that held Bitcoin without rebalancing, falling from 39 to just 10.2, while the maximum drawdown is slashed. However, if she is concerned that short term market movements will impact the value of her investment, she can invest $500 every Monday for 52 consecutive weeks. For example, if Alice decides to invest a total of $26,000 into Bitcoin, she can make the whole investment at once.

Looking at the data from the past 6 months, Bitcoin has been significantly less risky than all these altcoins except for UNUS SED LEO.ĭollar-cost-averaging, or DCA, is a strategy that involves the periodic purchase of an asset using the same dollar value over time, as opposed to a lump-sum purchase.

Note that Polkadot was officially launched for trading in late August, hence its YTD data does not include the market-wide plummet in March.

0 kommentar(er)

0 kommentar(er)